Bank Guarantee

A Bank Guarantee is a guarantee from a lending institution such as a bank ensuring the liabilities of a debtor will be met.

In other words, if the debtor fails to settle a debt, the bank covers it. A Bank Guarantee enables the customer, or debtor, to acquire goods, buy equipment or draw down loans, and thereby expand business activity.

A client may ask you to provide a Bank Guarantee from a third party such as a Bank. This guarantee is for a specified amount, which is usually a percentage of the total value of the contract. The Bank Guarantee is valid for a specified duration after which it expires.

In a transaction between a large organization and a small organization, the larger organization (Supplier) is at risk of not receiving the money owed for providing Items/Services so it will receive a Bank Guarantee from the smaller organization (Customer). A Bank Guarantee ensures that the larger organization gets money in case the smaller organization is not able to deliver.

To access the Bank Guarantee list, go to:

Home > Accounting > Banking and Payments > Bank Guarantee

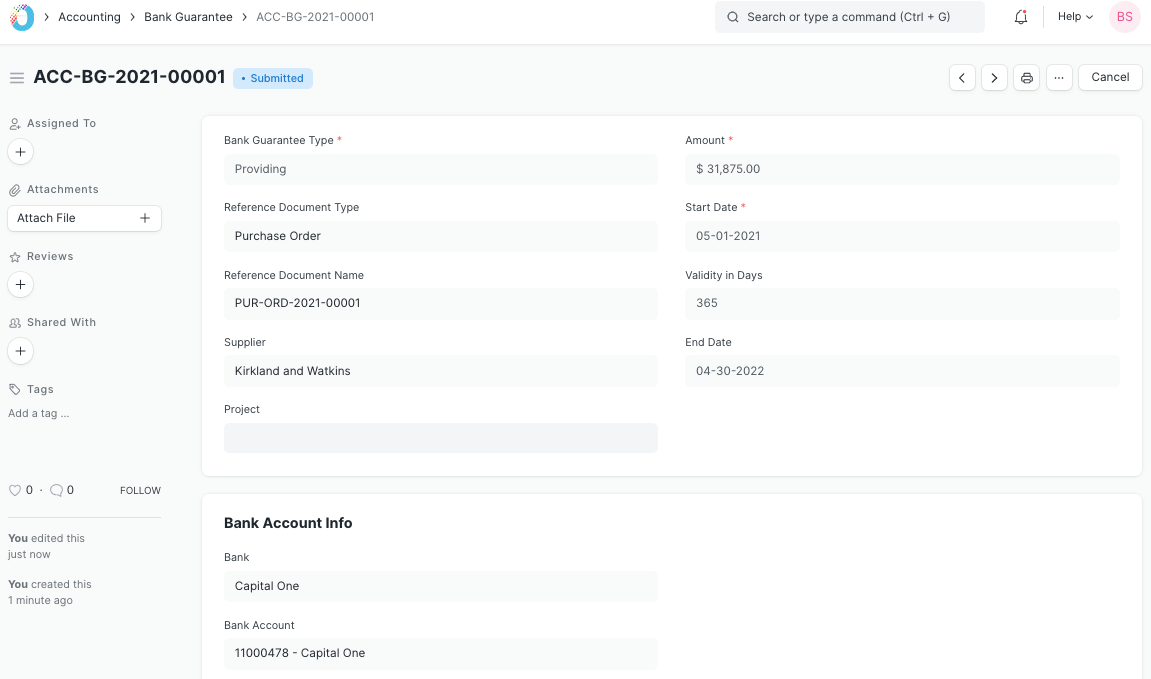

1. How to create a Bank Guarantee

- Go to the Bank Guarantee list and click on New.

- Select the type whether you're Receiving a Bank Guarantee from a Customer or Providing it to a Supplier.

- Set the Start Date and under 'Validity in Days' enter the number of days the guarantee is valid for.

- Select the Sales Order or Purchase Order depending on step 2.

- The Customer/Supplier and the Amount will be fetched automatically.

- Select a Bank and the Bank Account.

- Enter a Bank Guarantee number and name of the beneficiary.

- Save and Submit.

This document allows you to track Bank Guarantees given to Suppliers and received from Customers. You can set Email Alerts as the Bank Guarantee expiry date approaches to remind yourself to get the Bank Guarantee back from your client.

1.1 Additional Options when creating a Bank Guarantee

- Margin Money: This is some percentage of money paid to the Bank to proceed with the Bank Guarantee.

- Charges Incurred: Handling charges charged by the Bank.

- Fixed Deposit Number: In case the providing party has any Fixed Deposits, they can use them for proceeding with the Bank Guarantee.